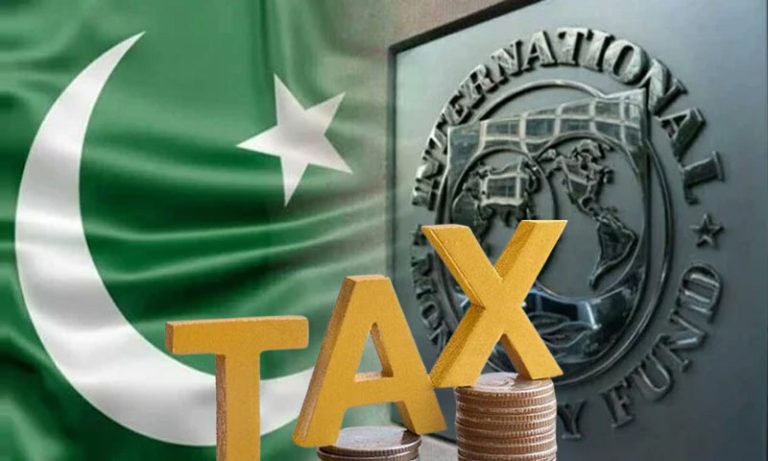

Pakistan Signs $7 Billion Loan Agreement with IMF, Committing to Tax Reforms

Islamabad:Pakistan has finalized a loan agreement of $7 billion with the International Monetary Fund (IMF), wherein the government has assured the IMF of implementing taxes on agricultural income and the retail sector, and increasing the number of taxpayers by including other sectors in the tax net.

Before the new agreement, what sectors did the IMF demand taxes on from the government?

It is known that during negotiations between the IMF and federal and provincial governments, the IMF demanded taxes on agricultural income, which the provincial governments have also accepted. Now, those earning more than 600,000 annually from agricultural income will have to pay tax, while those earning more than 10 million annually will have to pay a tax of 45% as income tax.

The IMF has demanded taxes on agricultural income and the livestock sector by October of the current year, while federal and provincial governments have also confirmed the implementation of these taxes.

The IMF has demanded an increase in taxes on the retail sector during negotiations with the government delegation, in addition to requesting an increase in taxes collected from exports.

After the staff-level agreement, the IMF has also issued a statement stating that Pakistan needs reforms in fiscal and monetary policies, improvement in administrative matters of state-owned enterprises, increased human resources, and a conducive environment for investment in the country.

According to the IMF, after the agreements with Pakistan in 2023, inflation decreased, reserves increased, and economic stability improved in the country last year. Now, with the new agreements, there will be an increase in tax revenue, and there is a possibility of an increase in the tax-to-GDP ratio by up to 3%.