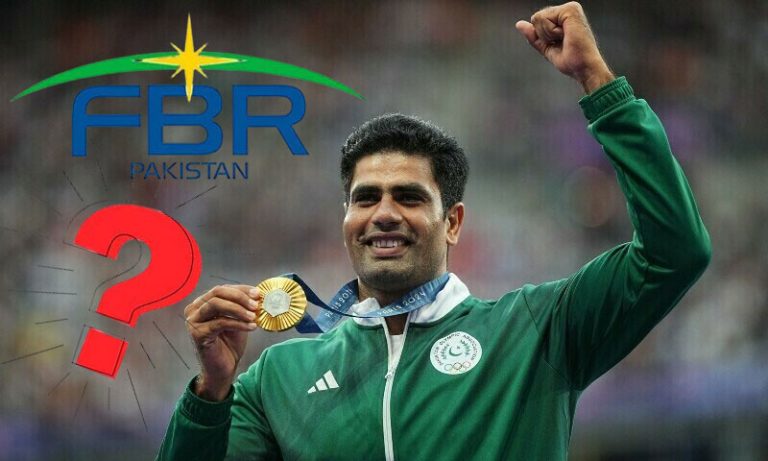

Islamabad:As preparations are underway for Arshad Nadeem’s return to Pakistan after securing a gold medal at the Paris Olympics 2024, there are growing discussions regarding the taxes on his prize money.

According to media reports, Arshad Nadeem has been awarded Rs. 14 million by the World Athletics Federation, in addition to other cash prizes, apartments, and cars announced from across Pakistan. It is estimated that he will receive a total prize amount exceeding Rs. 200 million.

The Federal Board of Revenue (FBR) has stated that athletes, like any lottery winners, are required to pay taxes on their prize money. The tax rate varies depending on whether the recipient is a filer or non-filer. Filers are required to pay 15% tax, while non-filers must pay 30%.

Given that Nadeem’s total prize money may exceed Rs. 200 million, if he is a filer, he would need to pay Rs. 30 million in taxes. However, if he is a non-filer, the tax amount could rise to Rs. 60 million.

Social media users are urging the government to waive the tax on Nadeem’s prize money, arguing that such a deduction would undermine the achievement of a national hero who has brought glory to the country.

The Punjab Chief Minister Marium Nawaz has announced a reward of Rs. 100 million for the national hero, while the Sindh government has promised Rs. 50 million. The World Athletics Federation has awarded Rs. 14 million, and Governor Sindh Kamran Tessori along with singer Ali Zafar have collectively pledged Rs. 2 million. Additionally, ARY’s Salman Iqbal has announced an apartment in the ARY Laguna for the Olympic champion.